The Workload Paradox of AI Productivity

February 10, 2026AI frequently improves efficiency, yet organisations often respond by expanding analysis rather than reducing effort.

Financial institutions are weaving agentic AI into environments long dominated by structured, rule-based business systems. The key design question is no longer what’s the most advanced model? – but which configuration best fits our business architecture and operating model?

Architecturally, that means aligning where intelligence lives – and how it is governed – with the realities of single integrated platforms, modular estates, or best-of-breed ecosystems. The right approach is contextual. Centralisation is not automatically superior; the correct equilibrium depends on process ownership, data flows, and the institution’s architectural preferences.

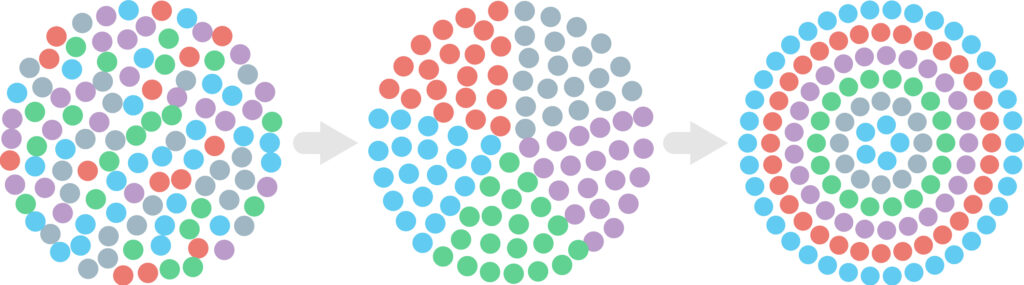

Before introducing any agentic capability, financial institutions must understand the environment it will inhabit. Most operate within one of three broad application architectures:

Each foundation offers different strengths in coherence, agility, and control. Single integrated platforms bring lineage and workflow assurance; best-of-breed environments maximise capability depth but increase orchestration complexity. Understanding this base is essential before layering in agentic intelligence.

Agentic systems can be arranged in three broad architectural patterns – each valid when matched appropriately to the core business applications it extends:

Each model balances agility, assurance, and simplicity differently – and each can be architecturally correct when aligned to the systems it complements.

Agentic AI can be deployed in different ways depending on the structure of an institution’s existing business systems.

The table below sets out nine viable configurations, formed by combining three system landscapes with three agentic operating models.

Think horses for courses. The right agentic architecture depends on the underlying system architecture it extends, and the level of control or autonomy required.

Designing the right agentic architecture follows a sequence:

Understand the current application landscape. Map how business processes, systems, and data flows are structured today.

Determine the required autonomy and assurance levels. Align to regulatory and risk expectations.

Select the agentic architectural model that balances agility, control, and coherence for that specific context.

Agentic AI doesn’t replace the institution’s core business systems – it complements and extends them. The important idea is alignment: deploying the agentic model that fits the function and the controls that fit the risk.

Back

Back

AI frequently improves efficiency, yet organisations often respond by expanding analysis rather than reducing effort.