Vendor Zoom: Stratiphy

August 20, 2025This Intelligence Vault article looks at the AI-driven retail investment platform Stratiphy

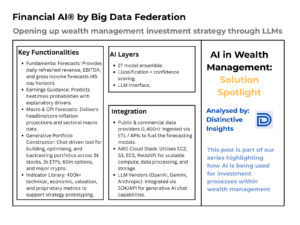

AI is lowering the barriers to investment strategy design — and one vendor we’ve been analysing is Big Data Federation.

Following on from our recent post on how AI is reshaping investment strategy design in wealth management, we’ve been exploring platforms bringing institutional-grade tooling to a broader audience.

One such example is Financial AI® by Big Data Federation — a US-based technology firm originally incubated within a quant hedge fund.

🔹 Used in-house, now opened up

Financial AI® is still used internally by quant teams, but is now being offered more broadly to discretionary managers, advisers, and semi-pro or pro retail traders.

🔹 Natural language interaction layer

Its most recent innovation is a generative agent that allows users to design and test portfolio strategies via conversation — combining LLM interfaces with underlying data and model infrastructure.

🔹 Data and functionality depth

➤ Forecasting engine built on a 27-model ensemble, including ecosystem and macroeconomic models

➤ Access to 400,000+ indicators across fundamentals, technicals, macro, and valuation

➤ Strategy construction across 5,000+ stocks, 3,000 ETFs, 60m options, and major cryptocurrencies

➤ Integrated backtesting and portfolio optimisation tools

The platform is built on a microservices-based AWS architecture and supports both web-based usage and raw data feeds — spanning use cases from macro scenario analysis to long/short portfolio modelling.

This is a notable example of how advanced modelling infrastructure is becoming more accessible across the wealth spectrum — particularly among firms serving active Mass Affluent to UHNW client segments.

📊 See more details in the image below.

Back

Back