Vendor Zoom: Stratiphy

August 20, 2025This Intelligence Vault article looks at the AI-driven retail investment platform Stratiphy

In our recent post on Lightyear’s funding round, we scanned the wider European retail market for AI-driven investment platforms — mapping how new entrants are combining automation, personalisation, and behavioural discipline.

Stratiphy’s UK launch this month is another example of that trend. The platform delivers:

📌 Personalised, AI-powered investment strategies targeting performance while aiming to reduce volatility

📌 Support for investor discipline — helping users maintain long-term commitments and avoid emotionally driven decisions during market instability

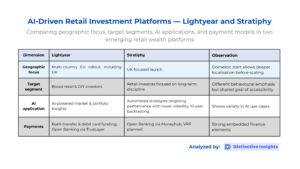

The image below compares Stratiphy’s approach with Lightyear’s across four dimensions we’ve been tracking — from geographic focus to AI use cases. In brief:

🟢 Lightyear — Pan-European reach; AI-powered market and portfolio insights

🟢 Stratiphy — UK-first rollout; automated strategies with 10-year backtesting; embedded Open Banking payments via Moneyhub with VRPs planned

Key Stratiphy capabilities:

🔹 Real-time 10-year backtesting for rapid portfolio stress-testing

🔹 Subscription-based access to professional-grade investment tools

🔹 Embedded Open Banking payments via Moneyhub, with VRPs planned

Looking ahead…

Lightyear and Stratiphy highlight how AI-powered investing platforms are moving from niche to mainstream — each with a distinct model and focus. As more platforms emerge, retail investors may start to expect the same analytical depth, behavioural support, and automation once reserved for institutional portfolios.

Back

Back